Understanding Medicare Fee-for-Service

Navigating the world of Medicare can feel like charting a course through uncharted waters. One of the most fundamental choices you'll face is deciding between Original Medicare, often referred to as fee-for-service, and Medicare Advantage. This exploration dives deep into the intricacies of the Medicare Fee-for-Service program, helping you understand its core principles, benefits, and potential drawbacks.

So, what exactly is the Medicare Fee-for-Service program? Simply put, it's a traditional payment system where Medicare pays directly for each covered healthcare service you receive. This means you can generally see any doctor or hospital that accepts Medicare, providing a broad network of providers. Unlike managed care plans like Medicare Advantage, fee-for-service gives you greater flexibility in choosing your healthcare professionals.

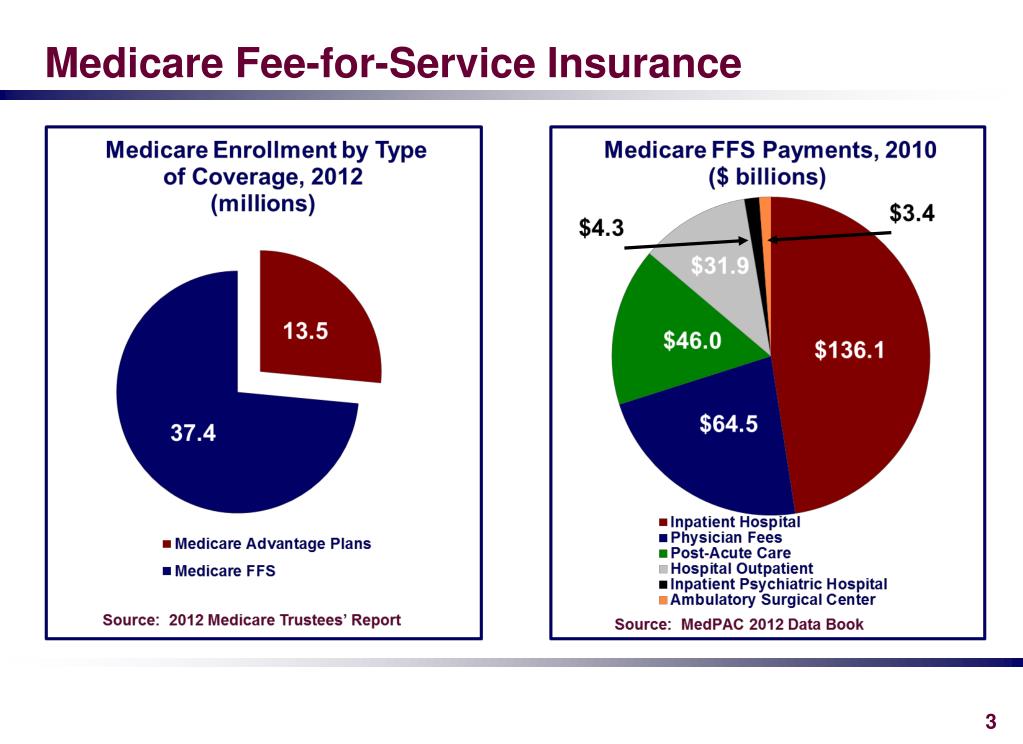

Understanding the origins of Medicare Fee-for-Service provides context for its current structure. Established in 1965 as part of the Social Security Act, it was the original way Medicare beneficiaries received their healthcare coverage. Over time, other options like Medicare Advantage emerged, but fee-for-service remains a cornerstone of the Medicare program, serving millions of Americans.

The importance of understanding the Medicare Fee-for-Service program cannot be overstated. It's a crucial piece of the healthcare puzzle for a significant portion of the population. Having a clear grasp of how this system operates empowers you to make informed decisions about your healthcare and financial well-being. Making the right choice for your individual needs is essential.

One of the main issues surrounding Medicare Fee-for-Service is its potential for higher out-of-pocket costs compared to Medicare Advantage plans. While fee-for-service offers greater flexibility in provider choice, it generally doesn't include prescription drug coverage or limit your out-of-pocket spending. This means you might be responsible for a larger share of your medical bills. Therefore, understanding these cost implications is paramount when deciding on the best Medicare coverage for you.

Medicare Fee-for-Service is broken down into two parts: Part A (hospital insurance) and Part B (medical insurance). Part A covers inpatient hospital stays, skilled nursing facility care, some home health care, and hospice care. Part B covers services like doctor visits, outpatient care, preventive services, and some medical equipment.

For example, if you break your leg and need surgery, Part A would cover your hospital stay, while Part B would cover your surgeon's fees and follow-up appointments. It's important to remember that you typically pay deductibles and coinsurance for both Part A and Part B services.

One benefit of Medicare Fee-for-Service is its broad provider network. You can see virtually any doctor or hospital that accepts Medicare assignment, giving you significant choice and flexibility. Another advantage is the simplicity of the program. You don't have to worry about networks, referrals, or pre-authorization for most services.

A third benefit is the predictability of coverage. Because the payment structure is transparent, you generally know what services are covered and how much you'll be responsible for paying.

Advantages and Disadvantages of Medicare Fee-for-Service

| Advantages | Disadvantages |

|---|---|

| Large provider network | Potentially high out-of-pocket costs |

| Simplicity and predictability | No prescription drug coverage (unless you enroll in Part D) |

| No referrals needed for specialists | No out-of-pocket maximum |

Frequently Asked Questions about Medicare Fee-for-Service:

1. What is the difference between Medicare Fee-for-Service and Medicare Advantage? Medicare Fee-for-Service is the traditional Medicare program, while Medicare Advantage plans are offered by private insurance companies approved by Medicare.

2. How much does Medicare Fee-for-Service cost? Costs include premiums, deductibles, and coinsurance for both Part A and Part B.

3. Do I need supplemental insurance with Medicare Fee-for-Service? Many people choose supplemental insurance (Medigap) to help cover out-of-pocket costs.

4. How do I enroll in Medicare Fee-for-Service? You can typically enroll through the Social Security Administration.

5. Can I see any doctor with Medicare Fee-for-Service? You can see any doctor or hospital that accepts Medicare assignment.

6. Does Medicare Fee-for-Service cover prescription drugs? No, you need to enroll in a separate Part D plan for prescription drug coverage.

7. What is Medicare assignment? It means the doctor or provider agrees to accept the Medicare-approved amount as full payment.

8. How can I find doctors who accept Medicare assignment? Use the Medicare Physician Finder tool on the Medicare.gov website.

In conclusion, understanding the Medicare Fee-for-Service program is essential for anyone approaching Medicare eligibility. While it offers flexibility and a broad provider network, it's important to weigh the potential for higher out-of-pocket costs. By carefully considering your individual needs and comparing Medicare Fee-for-Service with other options like Medicare Advantage, you can make an informed decision that empowers you to take control of your healthcare future. Take the time to research, ask questions, and consider your options. Your health and financial well-being depend on it.

Unlocking the mystery of eucalyptus grey

Unlocking student smiles navigating the waterloo student dental care network

Unraveling the enigma i am the villain chapter 26