Navigating Wells Fargo Cashier's Check Templates

Imagine this: you're about to make a large purchase, maybe a down payment on a house or a car. You need a payment method that's guaranteed and readily accepted. Enter the cashier's check. But what exactly is a cashier's check, and how do you get one from Wells Fargo? This journey into the world of cashier's checks, specifically at Wells Fargo, will uncover the nuances of these financial instruments, from their purpose to their procurement.

A cashier's check, sometimes referred to as a bank check, is a check guaranteed by a financial institution, drawn on the bank's own funds. Unlike a personal check, which draws on your individual account balance, a cashier's check represents the bank's promise to pay. This makes it a more secure form of payment for large transactions, as the recipient can be confident that the funds are available. When dealing with Wells Fargo, understanding their specific procedures for obtaining a cashier's check is crucial for a smooth transaction.

While the allure of a printable Wells Fargo cashier's check template might be tempting, it's important to understand that such templates don't exist for security reasons. Cashier's checks are highly regulated documents with specific security features to prevent fraud. Attempting to create a counterfeit cashier's check is illegal and can carry severe penalties. Instead of searching for printable templates, focus on understanding the legitimate process of acquiring a cashier's check directly from Wells Fargo.

The process of obtaining a cashier's check generally involves visiting a Wells Fargo branch. You'll need to provide identification and the exact amount for the check, along with any applicable fees. The bank will then prepare the cashier's check, which you can pick up and deliver to the recipient. This in-person process ensures the authenticity and security of the transaction, protecting both the payer and the payee.

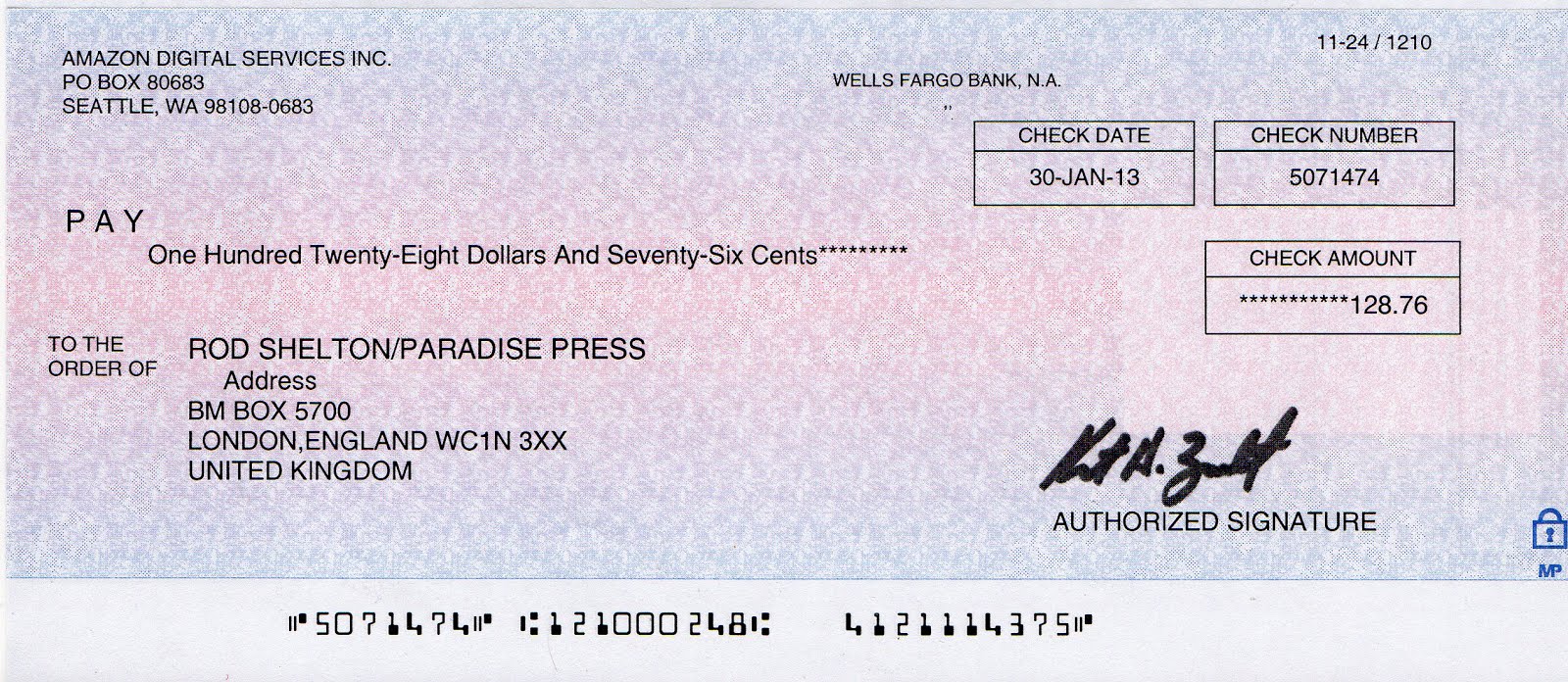

While there are no printable Wells Fargo cashier's check templates available, it's helpful to familiarize yourself with the information typically included on a cashier's check. This includes the payer's name, the payee's name, the amount, the bank's information, and various security features. Understanding these elements helps in verifying the legitimacy of a cashier's check you receive. It's crucial to differentiate between wanting a visual representation for informational purposes and seeking a printable template for fraudulent activities.

Cashier's checks have a long history, evolving from bills of exchange used in medieval times. Their importance lies in providing a secure payment method for significant transactions. A key issue surrounding cashier's checks is the potential for fraud if not handled properly.

Let's define a cashier's check again: a check guaranteed by a bank, drawn on the bank's own funds. For example, if you need to pay $20,000 for a car, you can obtain a cashier's check for that amount from Wells Fargo.

Benefits of a cashier's check include guaranteed payment, increased security, and wider acceptance for large transactions.

To obtain a Wells Fargo cashier's check, visit a branch with proper identification and the required funds.

Advantages and Disadvantages of Cashier's Checks

| Advantages | Disadvantages |

|---|---|

| Guaranteed Payment | Requires a trip to the bank |

| Increased Security | Involves fees |

| Wide Acceptance | Potential for scams if not handled carefully |

FAQs:

1. Can I print a Wells Fargo cashier's check template? No, for security reasons.

2. Where do I get a Wells Fargo cashier's check? At a Wells Fargo branch.

3. What do I need to get a cashier's check? Identification and the funds.

4. Is a cashier's check safe? Yes, it's guaranteed by the bank.

5. How much does a cashier's check cost? It depends on the bank; inquire at Wells Fargo.

6. What information is on a cashier's check? Payer, payee, amount, bank info, security features.

7. Can cashier's checks be used for international transactions? In some cases, but inquire with the bank.

8. What should I do if I lose a cashier's check? Contact the issuing bank immediately.

Tips: Keep your cashier's check secure and record the check number. Verify the recipient's identity before handing over the check.

In conclusion, while the convenience of a printable Wells Fargo cashier's check template may seem appealing, it's essential to prioritize security and follow the proper channels. Cashier's checks are valuable tools for secure transactions, offering guaranteed payment and peace of mind. By understanding the process and avoiding fraudulent practices, you can effectively utilize cashier's checks for your financial needs. Remember to visit a Wells Fargo branch for legitimate cashier's checks, protecting yourself and ensuring a smooth transaction. Understanding the nuances of cashier's checks, their purpose, benefits, and acquisition process empowers you to navigate financial transactions with confidence and security. Be informed, be vigilant, and make sound financial decisions. By understanding the correct procedures and prioritizing security, you can leverage the benefits of cashier's checks for important transactions.

Memorial mass invitations a guide to honoring loved ones

Wake countys classic school calendar a deep dive

Effortless style low maintenance hairstyles for thin hair