Navigating the Landscape of BCBS Plan F Medicare Costs

In the labyrinthine world of healthcare, Medicare stands as a beacon, a testament to societal compassion. But navigating its supplemental options can feel like charting a course through uncharted waters. Among these options, Plan F, offered by Blue Cross Blue Shield (BCBS), has long held a prominent position. Understanding the financial implications, the BCBS Plan F Medicare cost, requires a journey of exploration, a careful weighing of variables and considerations.

Consider the vast expanse of healthcare needs, the unpredictable nature of illness. Medicare, while a cornerstone, doesn't cover every expense. This is where supplemental plans, like Plan F, enter the narrative, offering a safety net, a buffer against the unexpected. But this security comes at a price. Deciphering the nuances of BCBS Plan F Medicare premiums becomes a crucial step in planning for a secure financial future, especially in the golden years.

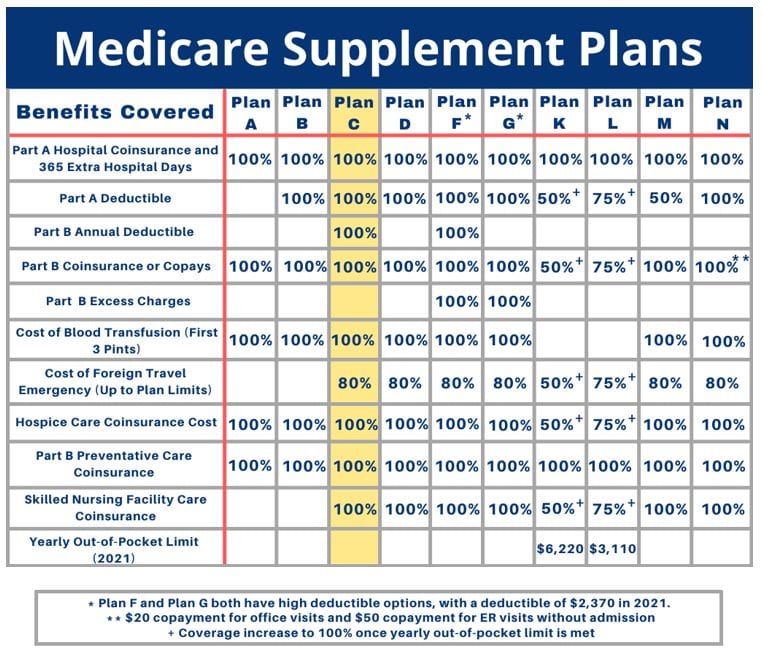

Historically, Plan F has been a popular choice, offering comprehensive coverage and peace of mind. However, changes in Medicare legislation have altered the landscape. New enrollees are no longer eligible for Plan F, though existing enrollees can maintain their coverage. This shift underscores the importance of understanding the broader context of Medicare supplements, recognizing that the landscape is dynamic, constantly evolving.

Understanding the cost of BCBS Plan F Medicare involves more than simply looking at the premium. It requires a holistic approach, considering factors such as deductibles, co-pays, and out-of-pocket expenses. One must weigh the potential costs against the potential benefits, a balancing act that requires careful consideration of individual health needs and financial circumstances.

This exploration of BCBS Plan F Medicare costs necessitates a deep dive into the mechanics of the plan. What services are covered? What are the limitations? How do these factors influence the overall financial equation? These are essential questions, the answers to which will illuminate the path toward informed decision-making.

While Plan F is no longer available to new Medicare beneficiaries, those enrolled before 2020 continue to benefit from its comprehensive coverage. This includes coverage for the Medicare Part B deductible, co-insurance, and excess charges, providing significant financial protection against unforeseen medical expenses.

Advantages and Disadvantages of BCBS Plan F Medicare

| Advantages | Disadvantages |

|---|---|

| Comprehensive Coverage | Higher Premiums |

| Predictable Out-of-Pocket Expenses | Not Available to New Enrollees |

| Peace of Mind | May Not Be the Most Cost-Effective Option for Everyone |

Navigating the complexities of Medicare can be challenging. Several resources can provide assistance: your local State Health Insurance Assistance Program (SHIP), the Medicare website (Medicare.gov), and BCBS directly.

Frequently Asked Questions about BCBS Plan F Medicare Costs:

1. What does BCBS Plan F cover? (Generally covers gaps in Original Medicare.)

2. How much does BCBS Plan F cost? (Varies based on location, age, and other factors.)

3. Can I still enroll in BCBS Plan F? (Not if you became eligible for Medicare after January 1, 2020.)

4. What are the alternatives to BCBS Plan F? (Plan G, Plan N, and other Medicare Supplement plans.)

5. How do I choose the right Medicare Supplement plan? (Consider your individual needs and budget.)

6. How do I find a BCBS Plan F provider? (Contact BCBS directly or use the Medicare.gov plan finder tool.)

7. What happens to my BCBS Plan F if I move? (Coverage may vary; contact BCBS.)

8. Can I switch from BCBS Plan F to another plan? (Yes, but with certain restrictions.)

Tips for managing BCBS Plan F costs: Compare plans annually, consider higher deductibles for lower premiums, and stay informed about changes in Medicare regulations.

In conclusion, understanding the landscape of BCBS Plan F Medicare costs is essential for anyone currently enrolled or considering their options. While Plan F provides comprehensive coverage and offers peace of mind, its higher premiums and unavailability to new enrollees require careful consideration. By weighing the advantages and disadvantages, utilizing available resources, and staying informed, individuals can make informed decisions about their healthcare coverage, ensuring a secure and well-planned future. Navigating the complexities of Medicare requires proactive engagement and a commitment to understanding the nuances of each plan. Empower yourself with knowledge, seek guidance from reputable sources, and make choices that align with your individual needs and financial goals. The journey to securing comprehensive healthcare coverage is a personal one, requiring careful consideration and a proactive approach.

Unlocking the longevity of your rav4 how many miles can you expect

Exploring behr solid color stain effectiveness

Kallang factory space fueling singapores industrial growth