Decoding Western Union Fees for International Money Transfers

Sending money across borders has become a vital part of our globalized world. Whether it's supporting family abroad, paying for international services, or managing investments, the need for efficient and affordable international money transfers is paramount. Western Union stands as a prominent player in this space, offering a widely recognized service for moving funds internationally. But what are the real costs associated with using Western Union for your overseas money transfer needs?

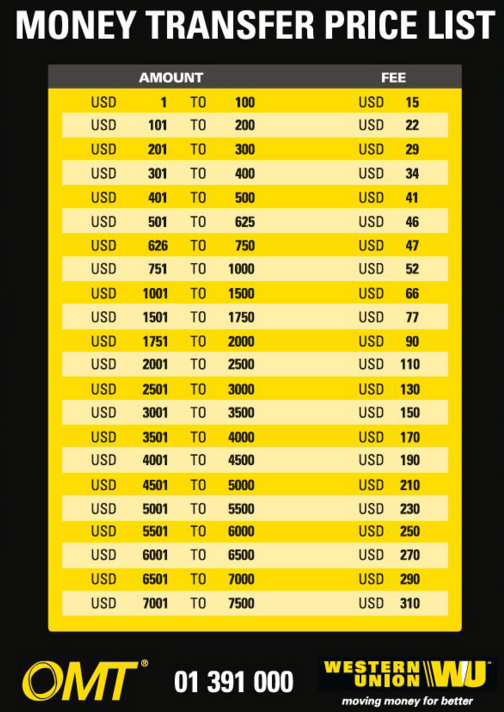

Understanding the pricing structure of Western Union's international money transfers can be crucial for making informed decisions. Factors such as the destination country, the amount being sent, the transfer method (online, in-person), and the payout method (bank account, cash pickup) can all influence the overall cost. This article aims to unpack the complexities of Western Union's fee structure and equip you with the knowledge to navigate the world of international money transfers effectively.

The Western Union Company's history dates back to 1851, originating as a telegraph company. Over the decades, it evolved, recognizing the increasing demand for reliable money transfer services. This shift cemented Western Union's position as a global leader in cross-border money movement. Today, Western Union's network spans over 200 countries and territories, providing a substantial infrastructure for individuals and businesses to transfer funds internationally.

The significance of Western Union's cost structure lies in its impact on both senders and recipients. For senders, understanding the fees and exchange rates allows them to budget effectively and minimize expenses. For recipients, the cost can influence the final amount received, impacting their financial planning. A key issue related to the cost of sending money via Western Union is transparency. While Western Union provides fee information, it can sometimes be challenging to quickly ascertain the total cost, including any exchange rate markups, before initiating the transfer.

Calculating the exact Western Union money transfer pricing involves considering the base fee, which varies depending on the destination and transfer amount, and the exchange rate markup. The exchange rate used by Western Union often includes a margin compared to the mid-market rate, impacting the final amount received. For example, sending $1000 to a specific country might incur a base fee of $10, but the exchange rate margin could add another implicit cost.

Western Union offers various services related to international money transfers. These include sending money online through their website or app, visiting a physical agent location, and setting up recurring transfers. They also offer different delivery options such as cash pickup, direct-to-bank account transfers, and mobile wallet deposits.

One benefit of using Western Union is the vast network of agent locations, facilitating cash pickup in numerous countries. This is particularly advantageous for recipients who may not have access to bank accounts. The speed of transfers can also be a benefit, with some transfers arriving within minutes. Finally, the familiarity and brand recognition of Western Union provide a sense of reliability for many users.

Advantages and Disadvantages of Western Union

| Advantages | Disadvantages |

|---|---|

| Wide Network | Potentially Higher Costs |

| Speed of Transfers | Exchange Rate Markups |

| Brand Recognition | Limited Customer Service Options in Some Areas |

Frequently Asked Questions (FAQs)

1. How can I find the cost of sending money with Western Union? (Visit their website or app and use the price estimator.)

2. What factors affect the transfer fee? (Destination country, transfer amount, transfer method, payout method.)

3. What are the different ways to send money with Western Union? (Online, agent location, mobile app.)

4. How long does a Western Union transfer take? (Can vary from minutes to a few business days.)

5. What are the payout options for recipients? (Cash pickup, bank account, mobile wallet.)

6. How can I track my Western Union transfer? (Use the tracking tool on their website or app.)

7. What do I need to send money with Western Union? (Valid ID, recipient's details.)

8. What should I do if my transfer encounters a problem? (Contact Western Union's customer service.)

Tips for minimizing Western Union's international transfer costs include comparing fees with other money transfer providers, sending larger amounts less frequently (as smaller, frequent transfers incur more cumulative fees), and being mindful of exchange rate fluctuations.

In conclusion, understanding the intricacies of Western Union's cost to send money overseas is essential for anyone engaging in international money transfers. While Western Union offers the convenience of a vast network and rapid transfer speeds, it’s crucial to be aware of the potential fees and exchange rate markups involved. By carefully considering the various factors impacting cost, comparing services with other providers, and employing smart transfer strategies, you can navigate the world of international money transfers with greater financial awareness and control. Whether you’re supporting loved ones abroad or managing global business transactions, empowering yourself with knowledge about international money transfer costs can lead to significant savings and enhanced financial management. Take the time to research your options, compare pricing, and choose the transfer method that best suits your individual needs and financial goals.

Dive into romance snapping into love manhwa free online

Banishing boat seat mold a comprehensive guide

Your dream toyota rav4 awaits in scotland