Canceling Letters of Credit: A Necessary Guide

International trade often relies on intricate financial instruments, and the Letter of Credit (LC) is a cornerstone of this system. But what happens when circumstances change, and a previously agreed-upon transaction falls through? This necessitates a clear understanding of the process for requesting an LC cancellation.

An LC, or Letter of Credit, acts as a guarantee from a buyer's bank to a seller, assuring payment for goods or services provided the stipulated terms are met. It mitigates risks for both parties involved in international trade. However, situations arise where a transaction might be canceled, requiring a formal request to terminate the LC. This guide will navigate you through the essentials of drafting and submitting an LC cancellation request to your bank.

Submitting a request to revoke a letter of credit is a critical process in international trade. Understanding the nuances involved can save businesses from potential financial pitfalls. A poorly drafted or untimely request can lead to complications and disputes. Therefore, it is crucial to approach this procedure with meticulous care and precision.

The history of LCs dates back centuries, evolving from simple promises of payment to the complex, internationally recognized instruments they are today. Their primary function remains to facilitate trust and security in global commerce. The process of requesting cancellation reflects this history, requiring formality and clarity to ensure all parties understand the change in circumstances.

A formal request for LC termination is essential for several reasons. It officially releases both parties from their obligations under the LC, prevents unintended payments, and clarifies the status of the transaction. Without a proper cancellation, the LC remains active, potentially leading to confusion and financial repercussions.

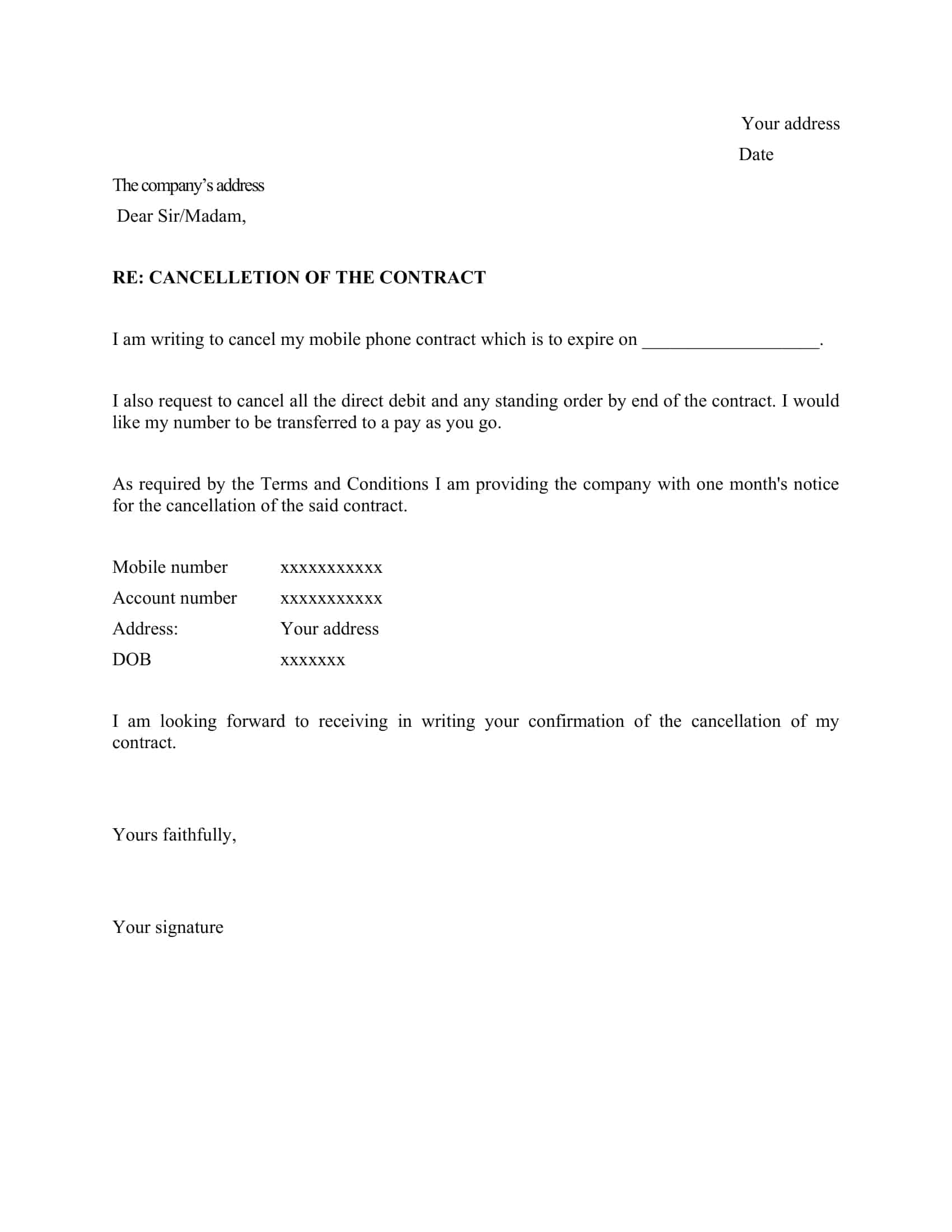

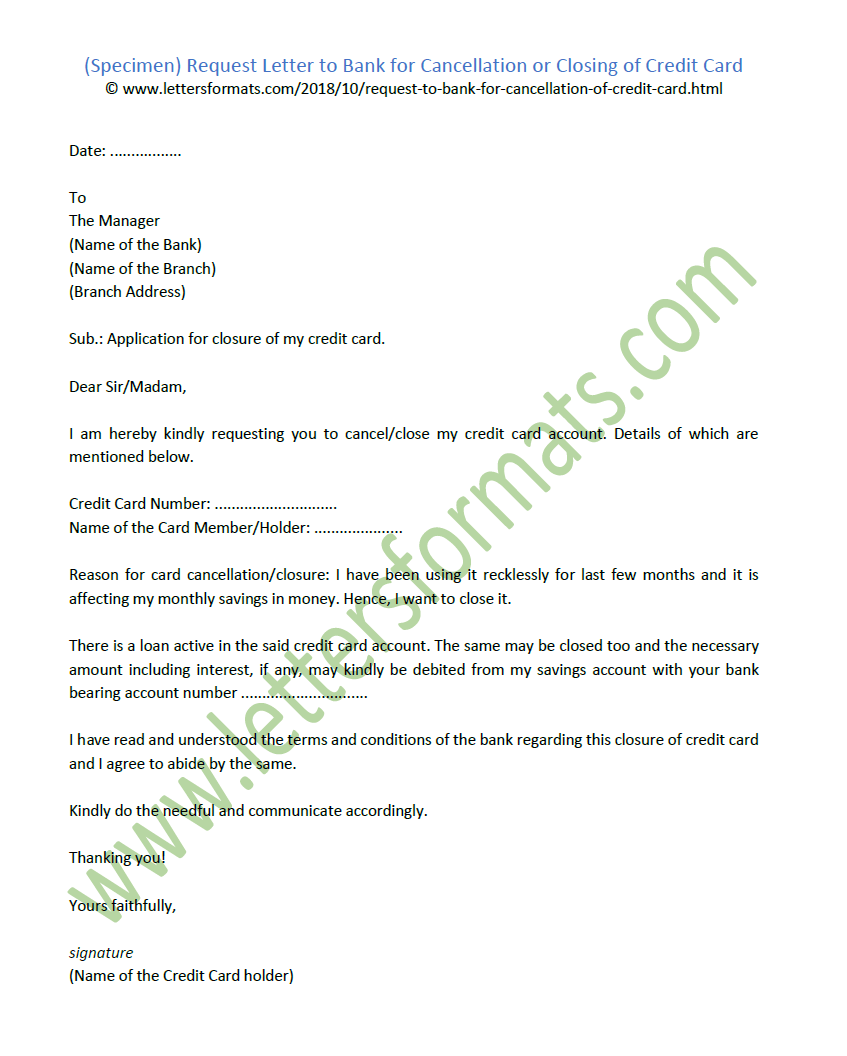

Terminating an LC involves notifying the issuing bank in writing of the intent to cancel. This communication, known as an LC cancellation request letter, should contain specific details, including the LC number, date of issuance, beneficiary details, and a clear statement of the cancellation request. For example, a simple request could state, "We request the cancellation of LC number [LC number] dated [date] issued in favor of [beneficiary name]."

Benefits of a correctly executed LC cancellation include avoiding unnecessary charges, preventing potential disputes, and maintaining a clear record of the transaction. For instance, canceling an unused LC avoids potential fees associated with its maintenance. Similarly, a clear cancellation prevents misunderstandings between the buyer and seller about the status of the transaction.

Action Plan for LC Cancellation:

1. Contact the beneficiary to confirm their agreement to the cancellation.

2. Draft a formal LC cancellation request letter, including all necessary details.

3. Submit the letter to your issuing bank through the appropriate channels.

4. Follow up with the bank to confirm receipt and processing of the request.

Advantages and Disadvantages of Canceling an LC

| Advantages | Disadvantages |

|---|---|

| Avoids unnecessary fees | Can strain relationships if not handled properly |

| Prevents potential disputes | May require renegotiation of terms if the transaction is to continue |

| Provides clarity on the transaction status | Can cause delays if not processed efficiently |

Best Practices for LC Cancellation:

1. Always obtain written confirmation from the beneficiary before requesting cancellation.

2. Ensure all necessary information is included in the cancellation request letter.

3. Submit the request in a timely manner to avoid potential complications.

4. Maintain clear communication with your bank throughout the process.

5. Keep records of all communication and documentation related to the cancellation.

FAQs about LC Cancellation:

1. What if the beneficiary refuses to agree to the cancellation? - Negotiation and alternative solutions might be necessary.

2. Can an LC be partially canceled? - This depends on the terms of the LC and the agreement between parties.

3. What are the fees associated with LC cancellation? - This varies between banks and depends on the specific LC.

4. How long does the cancellation process take? - This depends on the bank and the complexity of the LC.

5. What happens if the goods have already been shipped before the LC is canceled? - The LC might still be needed to complete the payment process.

6. Can an LC be reinstated after cancellation? - Generally, no, a new LC would need to be issued.

7. What are the legal implications of LC cancellation? - It's crucial to consult with legal counsel if there are disputes or complex circumstances.

8. Where can I find a template for an LC cancellation request letter? - Your bank can often provide templates, or you can find examples online.

In conclusion, navigating the process of requesting an LC cancellation demands a meticulous approach. A well-crafted and timely letter of credit cancellation request protects your business interests and maintains clarity in international transactions. Understanding the nuances of LC cancellations, including the importance of clear communication, adherence to best practices, and awareness of potential challenges, empowers businesses to navigate international trade with confidence and mitigate financial risks. By prioritizing a thorough understanding of this process, businesses can effectively manage their financial obligations and build stronger relationships with their trading partners. Consult with your bank or a trade finance specialist for guidance tailored to your specific situation. This proactive approach ensures smooth transactions and contributes to successful international trade ventures.

Unleash your creativity exploring the power of free tarpaulin layouts

Fc 24 live editor malfunction decoded

Unveiling the beast silverado 2500 hd diesel curb weight decoded